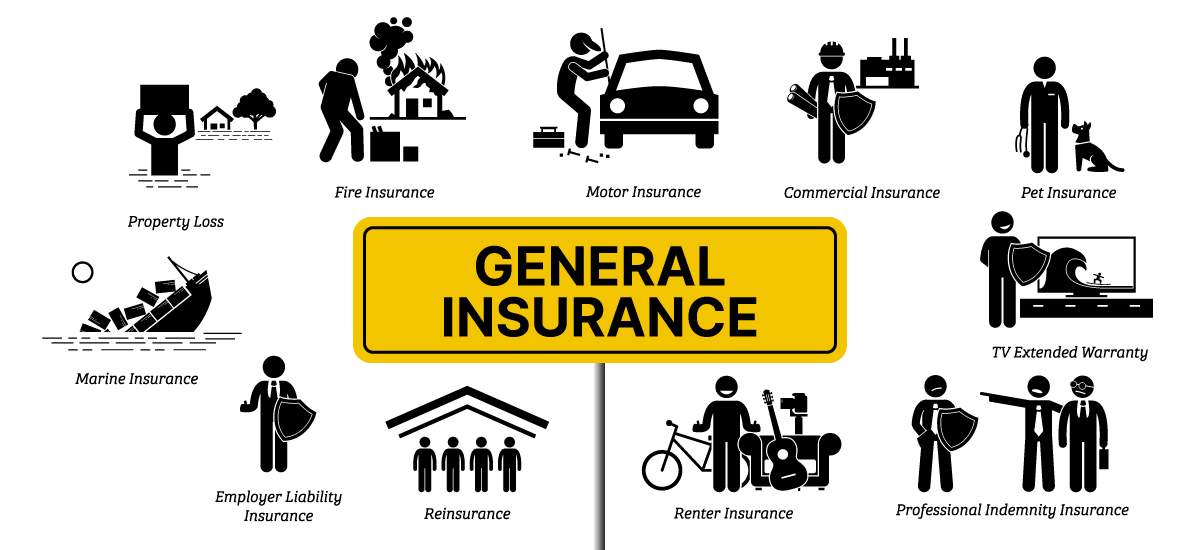

General Insurance

General insurance covers various non-life aspects, such as property, vehicles, travel, and health, providing financial protection against unexpected events like accidents, natural disasters, or liabilities. It offers short-term coverage for specific risks and does not typically accumulate cash value.

Get Started

What is General Insurance?

General insurance encompasses a broad spectrum of non-life insurance policies designed to protect individuals, businesses, and properties against financial losses from unforeseen events like accidents, natural disasters, liabilities, or health-related incidents. Unlike life insurance, which covers individuals for life, general insurance offers short-term coverage for specific risks. It includes various types of insurance such as auto, home, travel, health, and liability insurance, among others, each tailored to address distinct risks and provide financial security in times of need.

Type of General Insurance:

- Auto Insurance: Covers damage or loss to vehicles and provides liability coverage in case of accidents.

- Insurance: Protects against damage or loss to homes and belongings due to events like fire, theft, or natural disasters.

- Travel Insurance: Offers coverage for trip cancellations, medical emergencies abroad, lost luggage, or travel-related mishaps.

- Health Insurance: Provides coverage for medical expenses, treatments, hospitalization, and sometimes preventive care.

- Business Insurance: Includes various policies like property, liability, and workers' compensation to protect businesses from financial losses.

- Liability Insurance: Covers legal liabilities arising from injuries or damages to others or their property.

- Marine Insurance: Protects against losses or damage to ships, cargo, terminals, and any transport by water.

- Pet Insurance: Covers veterinary expenses for pets, including illness, accidents, or preventive care.